Challenges in Debt Collection

Debt collectors are generally not very loved or welcomed into the lives of consumers. Debt collection cases often include financial stress, and the collectors are sometimes associated with aggressive tactics. This perception partly comes from past industry practices, where some collectors used high-pressure phone calls, threats of legal action, or persistent messaging to recover debts, and partly from the impact of the financial stress consumers are actively experiencing. And while nobody wishes more money troubles onto anyone, the debts are due and when ignored, the problem only becomes bigger. To take the (financial) stress away from all parties, a solution is needed.

Changing this view on the debt collection industry as a whole can feel like an uphill battle - also because debt collection will never be a 'fun' topic for most people. So how do you convince consumers to start the conversation and look for good solutions together when they start from a place of apprehension?

On top of this, cybercrime is a growing concern today's society. With every new technological advancement, there are fraudsters that try to abuse these new innovations to scam (online) consumers. As a result, many messages get filtered into spam folders preemptively, and payment requests (even the legitimate ones) can expect a lot of distrust from consumers. Warnings like "Don't click links" and "don't pay stuff you can't verify the validity of" ring very true, but what if the payment links provided are legit? The skepticism of consumers towards messages, especially those including easy payment links, make it hard for debt collectors to offer consumer-friendly services. Because the payment link may be easy, but if consumers don't dare click on it, it will be useless.

Lastly, debt collection is a highly regulated industry. And rightfully so, when handling personal consumer data and payments. Ensuring compliance to continuously changing global regulations is another challenging that debt collectors face on a daily basis.

How to Get Debtors to Pay?

One of the biggest struggles in debt collection is simply getting consumers to pay their debts. Many debtors ignore calls, emails and messages, either deliberately because they feel overwhelmed and cannot afford to pay, or unknowingly because the messages automatically get filtered into a spam inbox. On top of that, if the debtors don't recognize the number or address, they can assume that it's a scam of fraudulent message.

So, how do we get consumers to interact with our communication?

Use Upgraded SMS Services for User-Friendly Communication

Sending messages to debtors can be a great way to reach them, especially since messaging channels like SMS have very high open rates (98%) compared to email. But bland and unpersonal texts with crude payment links are uninviting for consumers to interact with.

This doesn't really sound like something you would like to interact with, right? Well, neither does the consumer. Add a little bit of feeling and a personalized touch, and the message will immediately feel more inviting. On top of that, offering two-way communication will allow you to interact with debtors in a more empathetic and approachable way. Instead of one-sided demands, conversations can be personalized, giving debtors options to negotiate, ask questions, or request extensions—all in real time.

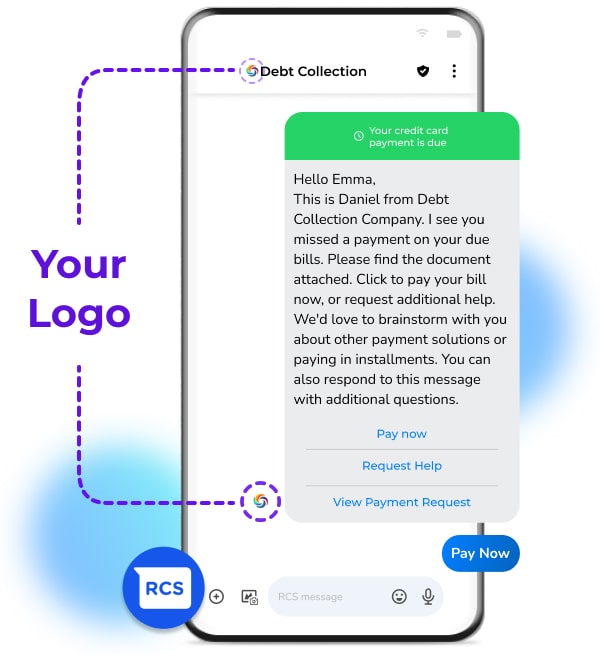

Better? Yes. Can we still improve it? Absolutely. With upgraded SMS services like RCS, the messages can be personalized and branded - this will give it an overall better look and feel and increase trust between you and the consumer.

RCS messages boost a 47% read rate, and 84% more conversion that SMS. And real-time customer data will help debt collectors to better understand the circumstances of their debtors, resulting in better targeted communication and solutions.

So, this is it? This is the best it gets? Well, no. RCS messaging has more tricks up its sleeve. Use media cards, QR payment links and buttons to liven up your messaging. In fact, there are several (case) studies that have found that buttons increase CTR rates, sometimes even by 133%!

RCS for Debt Collection in Brazil

In Brazil, RCS is actively used in debt collection by (one of the biggest) financial institutions. They adopted RCS for its visual and interactive nature, hoping to enhance engagement and potentially making their communication less confrontational, which would lead to an overall better experience for the debtor. The fact that RCS offers real-time two-way communication, allows debtors to negotiate payments or request support—improving success rates and reducing late or non-payments.

This emphasis on rich, interactive communication combined with a focus on improving the overall debt collection experience offers valuable insights and lessons for European debt collectors. looking to modernize their communication strategies and enhance engagement with debtors.

How to Gain Trust and Combat Fraud?

Beautifully branded and personalized messages are the first step to increasing consumer trust. But even fraudsters can create beautiful messages nowadays - imitating your business to near perfection and tricking consumers into clicking malicious payment links.

In 2022, around 30% of consumers and 85% of companies worldwide encountered phishing scams, and three in four organizations also reported having experienced smishing attacks (Statista)

It's awful to think that debtors who are already in financial distress would get scammed out of their money by spoofers pretending to be a debt collection agency. Fortunately, the danger of cybercrime is becoming common knowledge for most consumers. But that also makes them skeptic towards all messaging received - even your beautifully branded legit messages!

Increase Trust With Verified Sender Profiles

Verified sender profiles for RCS Business are a great tool to gain trust and showcase credibility. Consumers will see your business logo at the top of the message conversation, as well as your official company name, brand colors, and your business details such as your website, email address and telephone number. And on top of that, they will see the verified checkmark. All important cues for debtors to know that the messages received are legit and that the sender (you) can be trusted. And more trust means more engagement.

How to Ensure Compliance With Global and Local Regulations?

Debt collection is a highly regulated industry, with strict rules on communication, data security, and consumer rights. Using the wrong platform can lead to legal risks and reputational damage.

Which is why it is important to choose the right provider for your messaging services. Make sure that your (potential) provider is ISO-certified and adheres to GDPR and other secure data handling regulations and requirements. And that they adhere to these regulations without adding complexity to your systems or compromising delivery speed and reliability.

Making Debt Collection More Approachable

At the end of the day, debt collection is about helping people settle their financial obligations—not just chasing payments. With the right communication strategies over the right channels, collectors can move away from outdated tactics and adopt a modern, conversational approach.

With payment links or buttons, verified messaging, and two-way communication, debt collection becomes more efficient, trustworthy, and consumer-friendly—benefiting both collectors and debtors.

Ready to transform your debt collection process? Contact CM.com today to explore how RCS can help your business.